Unless you have already made a statutory off-road notification (SORN), it is your responsibility to make sure your car has the right insurance cover. As a result, it’s important to find out when your policy expires.

If you are unsure when your car insurance will run out, most insurers offer cover for a year. Therefore, if you can remember when your policy started, this is a good measure to use for checking your car insurance expiry date.

For policies that cover you for 10 months and over, insurers must send you a reminder for renewal before your insurance expires. Many insurers send you letters or emails to remind you to renew your cover ahead of its expiration depending on which type of communication you have chosen. As a result, it’s important to keep an eye out for this.

If you are concerned you may miss your renewal, so it’s important to keep an eye on when your car insurance is due to expire. There are several ways to find out when it will do so.

In this article, we address how to perform an insurance check and learn when your car insurance policy will expire. We also provide details on what to do in the event that it already has.

Is my car insured?

As previously stated, you may receive letters or emails reminding you of your renewal. If you have not, there are several other ways to find out when your policy will expire.

The first port of call when checking your insurance status is reading your policy papers. However, if you have lost these, you can also check your emails. Even if you can’t remember which insurer you took out cover with, you can often easily find the information by typing relevant words into the search bar. If you know who your insurer is, you can give them a call to find out the details of your policy.

Another option is to go through your bank or credit statements and look at outgoing payments – if you have set up a standing order, you may have informed your bank of the final payment.

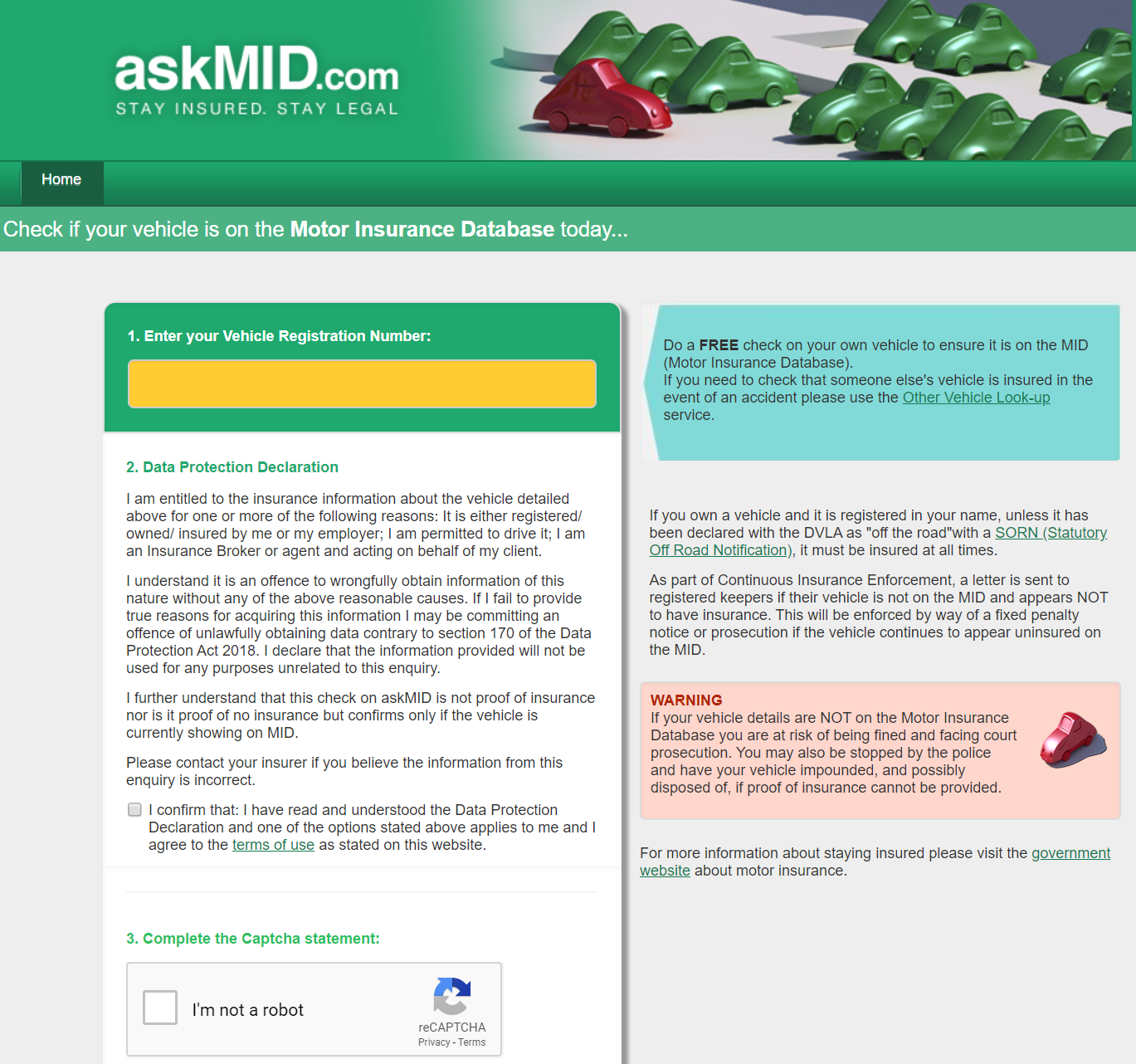

If these methods prove unsuccessful, you can visit askMID, an online insurance database checker. The site uses a national register to check car insurance by number plate. The search itself is free, however, you will need to pay a fee for additional information, such as the insurer’s details and policy information.

If your details are not on the Motor Insurance Database, you will be at risk of facing a fine or court prosecution.

My insurance has expired, what should I do?

If your car insurance has already expired, there are a number of things you should do to avoid a penalty and protect the safety of yourself and others.

- Do not drive your vehicle when it is not insured, as it is illegal to drive without insurance. You will need at least 3rd party insurance on a road or in a public place. If you are in an accident, you will be responsible for paying any compensation that you owe for damages or injury without an up-to-date policy.

- Speak to your insurance agent as soon as possible. They should be able to advise you on the best action to take, whether that’s updating your policy or getting a new one. They may also be able to help you avoid paying penalties for driving without insurance.

- Purchase the policy and ensure you get the cover as soon as you can. It is illegal for your car to not be insured (even if you’re not driving it) unless you have made a Statutory Off Road Notification (SORN).

- Keep hold of any documentation. Once you have your new policy in place, be sure not to lose any information that could help you when renewing in the future.

- Make a note in your diary, calendar or mobile and have a reminder set for when you will need to renew your policy next year.

What can I do if my car insurance has been declined?

You may find yourself being declined for insurance for many reasons, such as a failed direct debit payment, or adding incorrect personal details on your policy. There are a whole host of differing reasons as to why you may have been declined.

Online and automated systems often discriminate against drivers who have faced issues in the past, assuming that any problems were to do with fraud or criminal activity, wrongly making you a higher risk. Many insurers will either not offer you insurance, or will charge you an extortionate amount for your premium.

Whilst most insurers treat cancelled car insurance as a sign of foul play by you, at Adrian Flux we realise that most of the time it isn’t customers fault if their insurance is voided.

Do I need car insurance if I don’t plan on using my car?

Even if you do not plan on using your car, it will still need to be insured if you are keeping it on a public road. As mentioned above, if you plan on keeping your car, but are taking it off the road, then you will need to declare the vehicle as SORN.

Even when you SORN your car, you might still want to take out laid-up insurance, otherwise known as SORN insurance. This protects your car from damage, fire and theft while it’s not in use.

If you choose to SORN your vehicle, you will not be able to drive it or move it onto a public road without insuring it first.

What happens if I drive my car without car insurance?

If your car is uninsured, you will not be able to drive your vehicle on public roads or park it on the street. If you want to do this, you will need to take out car insurance. The minimum legal requirement for this is third party insurance, which provides cover for damage to other vehicles, people and property.

Driving without insurance is a serious motoring offence and could see between six and eight penalty points added to your driving licence and a fixed fine of £300. Read our guide to find out more information about what happens if you drive without insurance.

How can I get cheaper car insurance?

As a specialist insurance provider, we work hard to provide cover when other companies cannot. Get in touch to find a car insurance policy that works for you. Call us on 0800 081 0777 for a quote or book a callback at a time that suits you.