Learning to drive can be one of the most testing, expensive and exciting experiences in life.

Passing your test opens the doors to the world, allowing the freedom to drive where you want, when you want and what you want without depending on your parents or unreliable public transport.

In this guide, we’ve put together the best driving test tips to help you pass your test first time.

1. Practice a lot before your test

The average learner driver needs around 45 hours of lessons and 20 hours of private practice with a supervisor in order to be driving test ready. It’s important to remember that this is an average, so you might need more or less practice. Your driving instructor will have a much better idea about how close you are to being driving test ready, so it’s important to talk to them throughout your journey to passing the driving test.

Read more about how long it takes to pass your driving test in our blog.

2. Book a driving lesson on the day of your test

Get last-minute practise before your driving test by booking a final driving lesson just before your test. This will help to calm the nerves and get you in the right mindset for the test. Plus, it has the added benefit of preventing you from being late for the practical test.

You can also ask any last-minute questions in this session and go over any manoeuvres you’ve been struggling with.

3. Look at the most common driving test mistakes and learn from past mistakes

The most common driving test mistakes have remained more or less the same since records began in 2007. As a result, it’s a good idea to review these in order to prevent yourself from making the same mistakes.

4. Carefully consider where to take your test

If you live in a city, you might want to consider taking your driving test in a rural area as driving test pass rates are higher in these areas. You might also be able to book your driving test sooner in rural areas if you’re struggling to book a driving test because of the backlog.

In rural areas, you’re less likely to encounter complex hazards that could cause you to fail your test, so pass rates are higher here than in big cities. There is also generally less traffic on the road, meaning you’re less likely to get tripped up by the actions of other drivers on the road.

If you do decide to take your test in a rural area, you’ll probably still need to spend some time in the area getting used to rural driving. Roads are often more windy and hilly in the countryside, and rural roads often have a higher speed limit compared to their urban counterparts, so it’s a good idea to get used to this in the weeks leading up to your driving test.

5. Choose when to take your test carefully

It’s a good idea to avoid peak travel times as roads are more likely to be congested, meaning you’ll usually encounter more hazards during this time. If your schedule allows it, book your driving test in the evening – between 7pm and 9pm – to take advantage of the higher pass rate at this time.

6. Learn common routes in your driving test area

Once you’ve settled on your driving test centre, ask your driving instructor to take you around the most common driving test routes in the area. This can make you more comfortable in the area, and will also allow you to get used to common road signs, roundabouts and hazards in the area that might trip you up.

7. Make sure you know the driving theory well

It’s important that you know the driving theory well, especially when it comes to road signs and markings as these often trip up new drivers. It’s a good idea to continue testing your theory knowledge and reading the Highway Code so you can interpret road signs correctly.

8. Get everything ready the night before your test

There’s nothing worse than rushing around trying to find the documents you need just before your driving test. Instead, get everything together the night before your driving test is scheduled. This will help you remain calm in the hours leading up to your test. You’ll need to take along your:

- UK driving licence

- Theory test pass certificate if you have it

9. Record your private practices

Making a note of the private sessions and driving lessons you’ve had can help you understand how much time you’ve spent in control of the car and how far off you are from the average 45 hours’ driving lessons and 20 hours’ private practice.

You can also record things like the weather conditions you drove in and manoeuvres that you covered in each lesson to ensure you’re getting a well-rounded driving education.

If you don’t want to do this manually, consider downloading the FourFive Learner Driver app. The app allows you to record your private practice and will automatically let you know the weather conditions you drove in and the types of roads you drove on.

Better yet, the app also provides feedback on your drive, including any areas of improvement, as well as an incredible amount of official DVSA content, from hazard perception practice tests to theory test quizzes.

Download the FourFive app from the Play Store or App Store here.

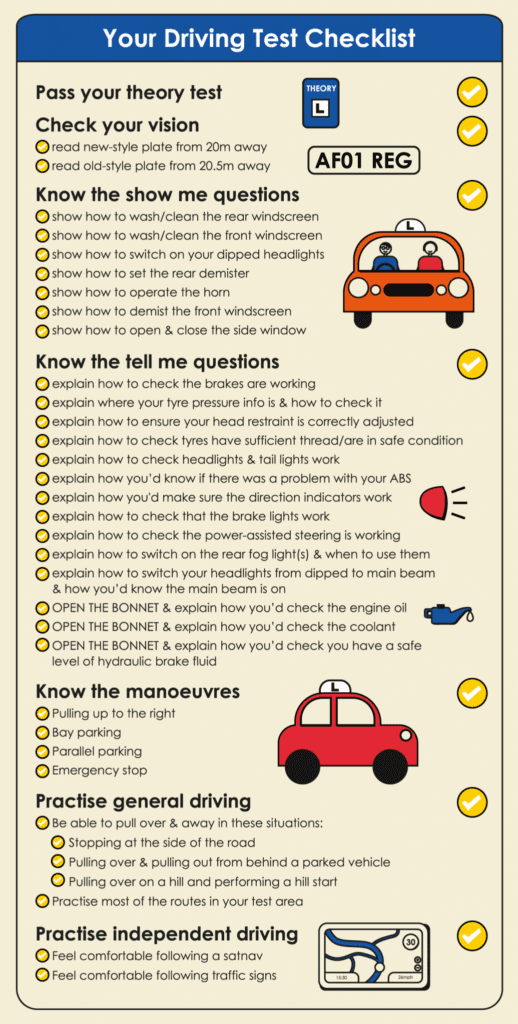

10. Brush up on the show me, tell me questions

The show me, tell me questions are completed before you start driving, so if you answer them correctly this can be a massive confidence booster and can set you up for a brilliant driving test. Make sure you brush up on the show me, tell me questions before your test.

This includes lifting the hood of the car and making sure you’re able to identify everything you need to for the show me questions. If you have a friend or family member who will run through them with you, even better.

11. Practice the driving test manoeuvres thoroughly

You’ll need to perform some of the driving test manoeuvres during your test. To make sure you pass your driving test first time, make sure you know these thoroughly. The driving examiner is likely to test you on the following:

- Pulling over and pulling away during your test, including:

- normal stops at the side of the road

- pulling out from behind a parked vehicle

- a hill start

- An emergency stop

- Reversing your vehicle through a:

- Parallel park at the side of the road

- Parking the car in a parking bay (either by driving in and reversing out, or reversing in and driving out)

- Pulling up on the right-hand side of the road, reverse for around two car lengths, and then rejoining traffic

12. Check your mirrors frequently

Many of the common driving test mistakes are related to individuals not observing their observation and learner drivers not being aware of their surroundings enough. An excellent way of proving to the driving instructor that you’re a safe driver is to check your mirrors frequently.

13. Make sure you’re anticipating hazards

The hazard perception portion of your driving test is a great example of when and how you should anticipate driving hazards. Make sure you’re looking far ahead enough to anticipate driving hazards and act accordingly. This can help you drive defensively too.

14. Only book your driving test when you’re a confident driver

Remember: it’s not all about the manoeuvres you know or your general driving ability. Even if you know how to perform each and every manoeuvre or how to pass every section of the driving test, if you don’t feel confident in your ability to pass, you likely need more time practising with your instructor.

Whilst driving test nerves are normal, you should still feel confident on the road. If you don’t, this might be a sign that you need to practise more before booking your test.

If you’re not feeling confident in specific areas, it’s a good idea to ask your driving instructor if you can go over these in your next lesson. Building up hours on the road should also help improve your confidence.

How do I know if I’m driving test ready?

If you’ve taken lessons for a few months, or even a couple of years, you might be wondering how close you are to knowing everything you need to pass your test. If so, take a look at our checklist. This can be a great way of directing your learner driver lessons. You might even find that you’re ready to book and pass your driving test!

I know everything on the list! What should I do now?

Congratulations! It might be a good idea to consider taking your driving test!

The best thing to do beforehand is to discuss this with your supervisor, who will have a better idea of your progress and if you’re ready. You could also ask them to schedule a mock driving test to get to grips with the format and to see how you would do in the real thing.

If you’re struggling to book your driving test, read our tips on how to keep your skills fresh and how to book it quickly. Plus, take a look at the driving test centres with the shortest waiting times.

I still have a few areas I’m not confident in. What should I do?

That’s okay, it’s best to be honest with yourself about this sort of thing! If you’re struggling with a specific manoeuvre or you don’t know the answers to some of the show me, tell me questions, you should ask your driving instructor to go through these with you in your next few lessons.

After that, it might be a good idea to schedule a mock test to see how you do. This could also help highlight where you need to improve.

In the meantime, there are a number of things you can do to boost your confidence and improve your knowledge so you’re as prepared as possible for your next lesson.

There are a number of resources online that can help, including how-to videos on how you can perform each manoeuvre and demonstrations for the show me, tell me questions. Knowing the theory can go a surprisingly long way in helping to prepare you for the real deal.

Get affordable learner driver insurance with Adrian Flux

It’s a good idea to practise manoeuvres and general driving skills with your supervisor, family or friends as this will help ensure you can pass your driving test first time. If you decide to practise with family or friends, make sure you have learner driver insurance. We offer cover from just 65p a day! Call us on 0800 369 8590 for a quote or book a callback at a time that suits you.